43 value of zero coupon bond

groww.in › p › zero-coupon-bondZero-Coupon Bonds : What is Zero Coupon Bond? - Groww Suitable Tenure for Zero Bond Coupon. The time and the maturity value of Zero Coupon bonds share a negative correlation. The longer until the maturity date, the less the investors have to pay for it. Therefore, the Zero Coupon bonds generally come with a time horizon of 10 to 15 years. What Is Duration Of A Bond? - LudoPrevención A zero-coupon bond is a bond that pays no interest and trades at a discount to its face value. These bonds are issued at a deep discount and repay the par value, at maturity. The difference between the purchase price and the par value represents the investor's return. The payment received by the investor is equal to the principal invested ...

Zero-coupon CDs: What they are and how they work - Bankrate Zero-coupon CDs, in comparison, are purchased at a lower price and you receive the entire interest amount at the CD's maturity date. So with a zero-coupon CD, you wait longer to receive the ...

Value of zero coupon bond

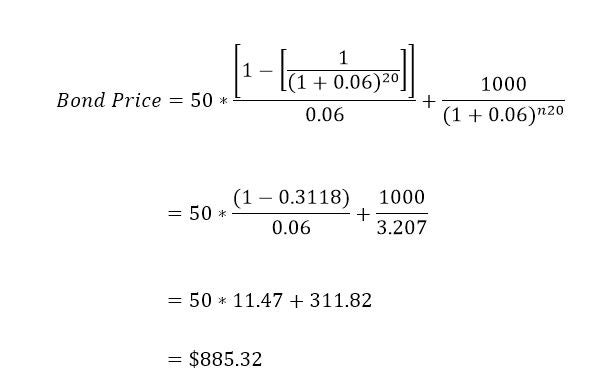

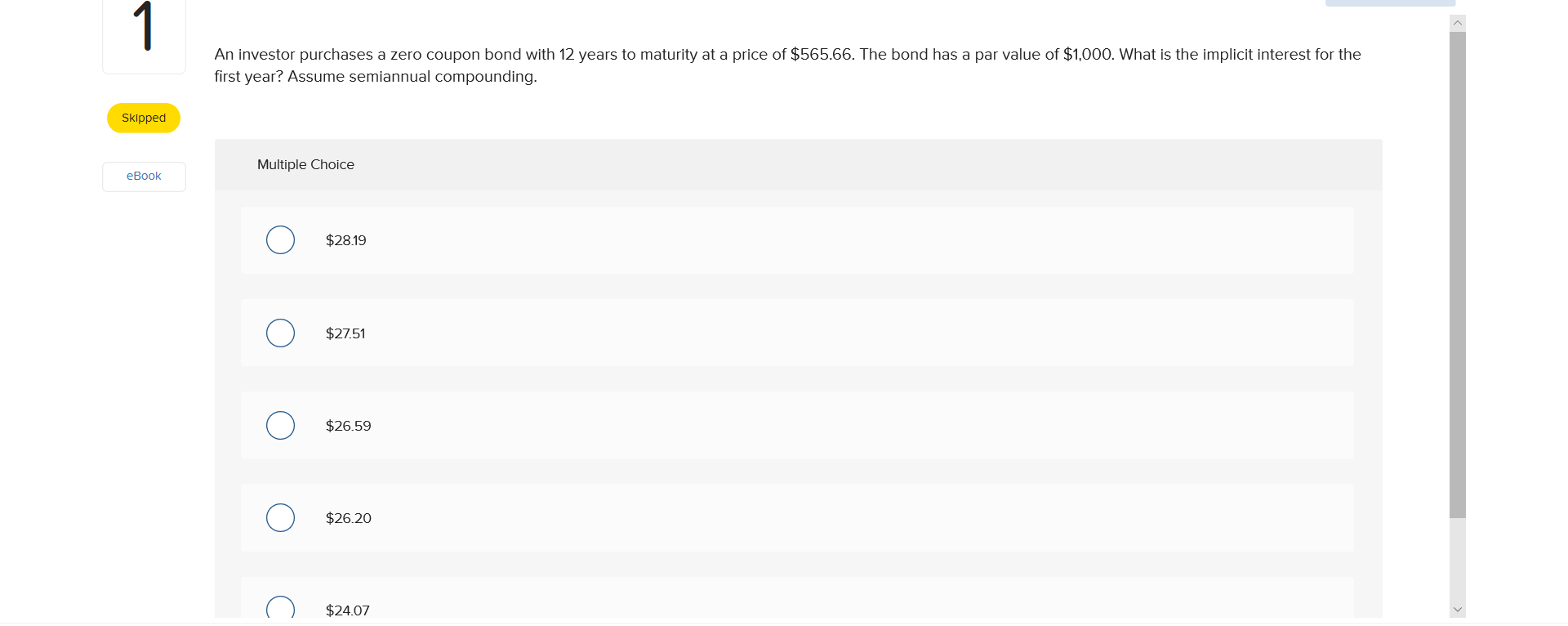

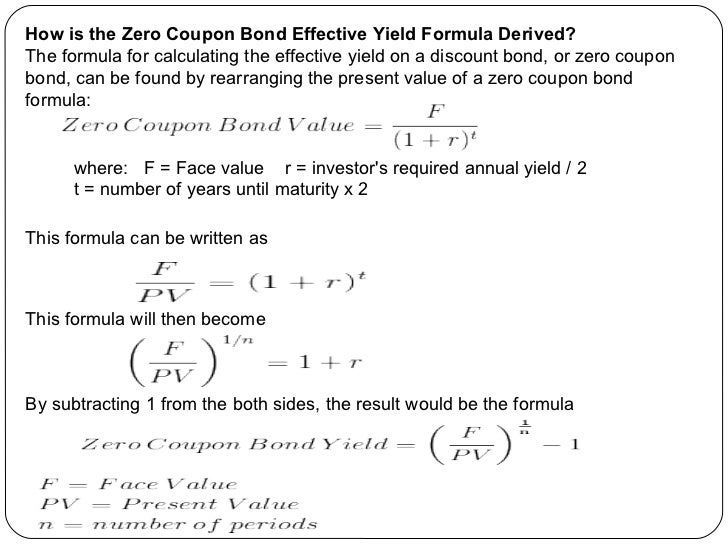

Calculating the Effective Yield of a Zero-Coupon Bond To calculate the return for a zero-coupon bond, the following zero-coupon bond effective yield formula is applied: [{F/PV}]^(1/t) =1+r. Where. F -face value of the bond. PV- current value of the bond. t -time to maturity. r- Interest rate. For example, an investor purchases a zero-coupon bond at $ 200, which has a face value at maturity of ... Pricing risk-based catastrophe bonds for earthquakes at an urban scale ... Figure 6 a,c shows the valuation for zero-coupon and coupon CAT bond for varied time to maturity and threshold levels, respectively. In case of zero-coupon bond (see Fig. 6 a), we observe that the... WHAT IS FACE VALUE? What is It's Significance? If a bond has a $1,000 face value and a 5% coupon rate, you will receive $50 in annual returns. This is in addition to the issuer repaying you the face value of the bond when it matures. ... Zero-coupon bonds, or those in which investors receive no interest other than the cost of purchasing the bond below face value, are typically sold below ...

Value of zero coupon bond. Understanding Zero Coupon Bonds - Part One - The Balance Here is an example of how zero coupon bond prices can change: For example, assume that three STRIPS are quoted in the market at a yield of 6.50%. The price for STRIPS with 25 years remaining to maturity would be $202.07 per $1,000 face amount That for STRIPS with 10 years remaining to maturity would be $527.47 per $1,000 face amount › terms › zZero-Coupon Bond Definition - Investopedia Nov 11, 2021 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... What Is a Zero-Coupon Bond? | The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 = $6,139.11 This means that given the above variables, you'd be able... Price of a Zero coupon bond - Calculator - Finance pointers Price of a Zero coupon bond - Calculator. August 20, 2021 | 0 Comment | 9:15 pm. The Price of a zero coupon bond is calculated using the following formula : = FV / ( 1 + r ) n. Where. P = Price of a zero coupon bond ; FV = Face value / Maturity value of the zero coupon bond ; r = Discount rate ; n = Term to maturity ; In the calculator below ...

Coupon Bond - Guide, Examples, How Coupon Bonds Work Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value. In this case, Apple will pay $5 in annual interest to investors for every bond purchased. After four years, on the bond's maturity date, Apple will make its last coupon payment. Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula. The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t. where ZCBV is the zero-coupon bond value. F is the face value of the bond. r is the yield/rate. t is the time to maturity. $1,000 par value zero-coupon bonds (ignore liquidity premiums) Bond ... $1,000 par value zero-coupon bonds (ignore liquidity premiums) Bond Years to Maturity Yield to Maturity A 1 6.00% B 2 7.50% C 3 7.99% D 4 8.49% E 5 10.70% - 24081884 corporatefinanceinstitute.com › zero-coupon-bondZero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Example of a Zero-Coupon Bonds . Example 1: Annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? 5 = $783.53. The price that John will pay for the bond today is $783.53.

Advantages and Risks of Zero Coupon Treasury Bonds If a zero-coupon bond is purchased for $1,000 and given away as a gift, the gift giver will have used only $1,000 of their yearly gift tax exclusion. The recipient, on the other hand, will receive... Original Issue Discount - Explained - The Business Professor, LLC Original Issue Discount and Zero-Coupon Bonds. Zero-coupon bonds are defined as bonds that have the highest original issue discounts. Investors make a profit or the OID only when the bond matures and pay the bond's face value. Investors are generally attracted to Zero-coupon bonds due to the fact that fluctuations in interest rates have no ... How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. Zero Coupon Bond -Features, benefits, drawbacks, taxability, & FAQs Zero coupon bonds fall under the fixed-income securities segment. These don't pay any interest or coupon, and at the time of maturity, the investor receives the face value or par value. Zero coupon bonds are also referred to as 'Zeroes' by many traders for this reason. These bonds generally have 10-15 years to maturity.

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Typically, the following formula is used to calculate the sale price of a zero-coupon bond based on its face value and maturity date. Zero-Coupon Bond Price Formula Sale Price = FV / (1 + IR) N...

What is a Zero Coupon Bond? - ICICIdirect The formula used to calculate the price of zero-coupon bonds is: Price = Face Value/ (1+r)^n . Where r is the annual return, and n is the number of years until maturity. Why invest in a Zero Coupon Bond 1. Returns are predictable . The most significant advantage of a zero-coupon bond is that the returns that you receive on them are known in ...

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73.

Low Fair Value Of Zero Coupon Bonds Will Slash Bank's Capital Levels ... The fair value zero coupon bonds used to infuse capital into five Public Sector Banks could be lower affecting the banks' effective Tier 1 capital levels, according to India Ratings and Research. In the bid to ease fiscal pressure and save interest burden on banks, the government in 2020 started issuing zero coupon bonds to fulfill the capital needs of the banks.

What Are Corporate Bonds? | Nasdaq The investor's return is the difference between the purchase price paid for the bond and the par value. For example, a five-year zero-coupon bond with a par value of $1,000 might sell for $750....

› articles › investingHow to Calculate PV of a Different Bond Type With Excel Feb 20, 2022 · A. Zero Coupon Bonds . Let's say we have a zero coupon bond (a bond which does not deliver any coupon payment during the life of the bond but sells at a discount from the par value) maturing in 20 ...

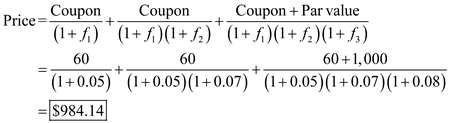

Government, Zero-Coupon & Floating-Rate Bonds - Study.com What is the price of a three year zero coupon bond if the annual interest rate in 1 year will be 3% and the annual interest rate in 2 years and 3 is 4%.? The face value of the bond is $1,000 and you m

Zero Coupon Bond Funds: What Are They? - The Balance A zero coupon bond is a bond that doesn't offer interest payments but sells at a discount—a price lower than its face value. 1 The bondholder doesn't get paid while they own the bond, but when the bond matures, they will be repaid the full face value. Zero coupon bond funds are funds that hold these types of bonds.

Zero Coupon Bond: Definition, Formula & Example - Study.com Invest in a reputable bond mutual fund that provides annual returns of 3%. You deem this to be an acceptable rate of return. Purchase a $10,000 Zero Coupon Bond from Company X that matures in 5...

en.wikipedia.org › wiki › Corporate_bondCorporate bond - Wikipedia The coupon can be zero. In this case the bond, a zero-coupon bond, is sold at a discount (i.e. a $100 face value bond sold initially for $80). The investor benefits by paying $80, but collecting $100 at maturity. The $20 gain (ignoring time value of money) is in lieu of the regular coupon. However, this is rare for corporate bonds.

38 present value of a zero coupon bond 1. Calculate the present value of a $1000 zero-coupon bond with five years to maturity if the yield to maturity is 6%. 2. Consider a coupon bond that has a $1000 par value and a coupon rate of 10%. The bond is currently selling for $1150 and has eight years to maturity. Bond Present Value Calculator - buyupside.com Bond Present Value Calculator.

Zero coupon bond definition — AccountingTools Zero coupon bond definition January 15, 2022 What is a Zero Coupon Bond? A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond. Disadvantages of Zero Coupon Bonds

Zero Coupon Bond - Explained - The Business Professor, LLC Unlike the regular, coupon-paying bonds, a zero-coupon bond has an imputed interest rate (rather than an established interest rate). To illustrate, if a bond with a face value of $1,000 matures in 20 years with a 5.5% annual yield, can be purchased at $3,378. This represents $1,000 in value in 20 years if the money compounds annually for 20 years.

What Is Duration of a Bond? - TheStreet Definition - TheStreet By examining three different bonds, zero-coupon bonds, short-term bonds and long-term bonds, we can shed light on just how much duration can affect its value. Zero-Coupon Bonds.

WHAT IS FACE VALUE? What is It's Significance? If a bond has a $1,000 face value and a 5% coupon rate, you will receive $50 in annual returns. This is in addition to the issuer repaying you the face value of the bond when it matures. ... Zero-coupon bonds, or those in which investors receive no interest other than the cost of purchasing the bond below face value, are typically sold below ...

Pricing risk-based catastrophe bonds for earthquakes at an urban scale ... Figure 6 a,c shows the valuation for zero-coupon and coupon CAT bond for varied time to maturity and threshold levels, respectively. In case of zero-coupon bond (see Fig. 6 a), we observe that the...

Post a Comment for "43 value of zero coupon bond"