44 us treasury coupon rate

US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,686 datasets) Refreshed 14 hours ago, on 8 Aug 2022 Frequency daily Description These yield curves... Treasury Yield Definition - Investopedia For example, if a 10-year T-note with a face value of $1,000 is auctioned off at a yield of 3%, a subsequent drop in its market value to $974.80 will cause the yield to rise to 3.3%, since the...

10-Year US Treasury Note - Guide, Examples, Importance of 10-Yr Notes The 10-year US Treasury note offers the longest maturity. Other Treasury notes mature in 2, 3, 5, and 7 years. Each of these notes pays interest every six months until maturity. The 10-year Treasury note pays a fixed interest rate that also guides other interest rates in the market. For example, it is used as a benchmark for other interest ...

Us treasury coupon rate

US5Y: U.S. 5 Year Treasury - Stock Price, Quote and News - CNBC Latest On U.S. 5 Year Treasury U.S. 10-year Treasury yield jumps after jobs growth blows past expectations August 5, 2022 CNBC.com 10-year yield slides below 2.70% as jobless claims increase ... 20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 3.15%, compared to 3.17% the previous market day and 1.74% last year. This is lower than the long term average of 4.37%. Stats 30 Year Treasury Rate The 30 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 30 years. The 30 year treasury yield is included on the longer end of the yield curve and is important when looking at the overall US economy. Historically, the 30 year treasury yield reached upwards of 15.21% in 1981 ...

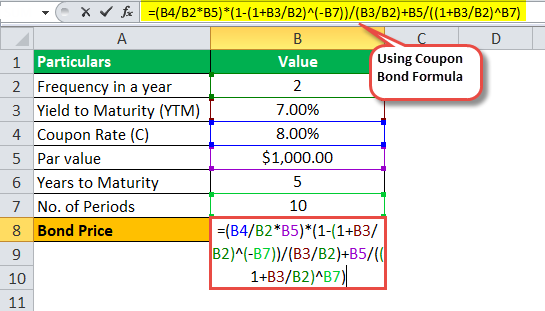

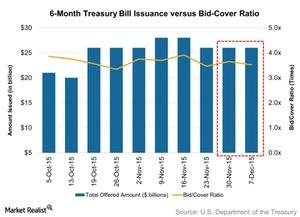

Us treasury coupon rate. Treasury Return Calculator, With Coupon Reinvestment - DQYDJ Treasury Return Calculator, With Coupon Reinvestment Investing August 8th, 2022 by PK The Treasury Return Calculator below uses long run 10-year Treasury Data from Robert Shiller to compute returns based on reinvesting the coupon payments. You can see the total returns for the 10 Year Treasury for any arbitrary period from 1871 until today. Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... How Are Treasury Bill Interest Rates Determined? - Investopedia After the investor receives the $1,000 at the end of the 52 weeks, the interest rate earned is 2.56%, or 25 / 975 = 0.0256. The interest rate earned on a T-bill is not necessarily equal to its... Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction.

Understanding Treasury Bond Interest Rates | Bankrate What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value)... Treasury Bill Rates - NASDAQ - Datastore The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also called the... US10Y: U.S. 10 Year Treasury - Stock Price, Quote and News - CNBC Yield Open 2.75% Yield Day High 2.775% Yield Day Low 2.746% Yield Prev Close 2.763% Price 100.875 Price Change -0.0781 Price Change % -0.0781% Price Prev Close 100.9531 Price Day High 101.0938... Should You Buy Treasuries? - Forbes The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison, Nerdwallet reports the national average rate on a high-yield savings account is .70%. (Note: both figures are annualized, so...

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury Index... US2Y: U.S. 2 Year Treasury - Stock Price, Quote and News - CNBC Latest On U.S. 2 Year Treasury U.S. 10-year Treasury yield jumps after jobs growth blows past expectations August 5, 2022 CNBC.com 10-year yield slides below 2.70% as jobless claims increase ... EOF US30Y: U.S. 30 Year Treasury - Stock Price, Quote and News - CNBC Price Day Low 95.5312 Coupon 2.875% Maturity 2052-05-15 Latest On U.S. 30 Year Treasury Treasury yields fall to start August on signs that inflation may be cooling August 1, 2022CNBC.com 10-year...

30 Year Treasury Rate The 30 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 30 years. The 30 year treasury yield is included on the longer end of the yield curve and is important when looking at the overall US economy. Historically, the 30 year treasury yield reached upwards of 15.21% in 1981 ...

20 Year Treasury Rate - YCharts The 20 Year treasury yield reach upwards of 15.13% in 1981 as the Federal Reserve dramatically raised the benchmark rates in an effort to curb inflation. 20 Year Treasury Rate is at 3.15%, compared to 3.17% the previous market day and 1.74% last year. This is lower than the long term average of 4.37%. Stats

US5Y: U.S. 5 Year Treasury - Stock Price, Quote and News - CNBC Latest On U.S. 5 Year Treasury U.S. 10-year Treasury yield jumps after jobs growth blows past expectations August 5, 2022 CNBC.com 10-year yield slides below 2.70% as jobless claims increase ...

Post a Comment for "44 us treasury coupon rate"