42 present value of zero coupon bond calculator

Zero Coupon Bond - Explained - The Business Professor, LLC Apr 17, 2022 ... Below is the formula for calculating the present value of a zero coupon bond: Price = M / (1 + r)^n where M = the date of maturity r ... Bond valuation (Zero coupon bonds) |Calculator - Trignosource Zero-coupon bond pricing refers to finding out the fair value of a zero-coupon bond, which is simply the present value of the redemption amount of that bond ...

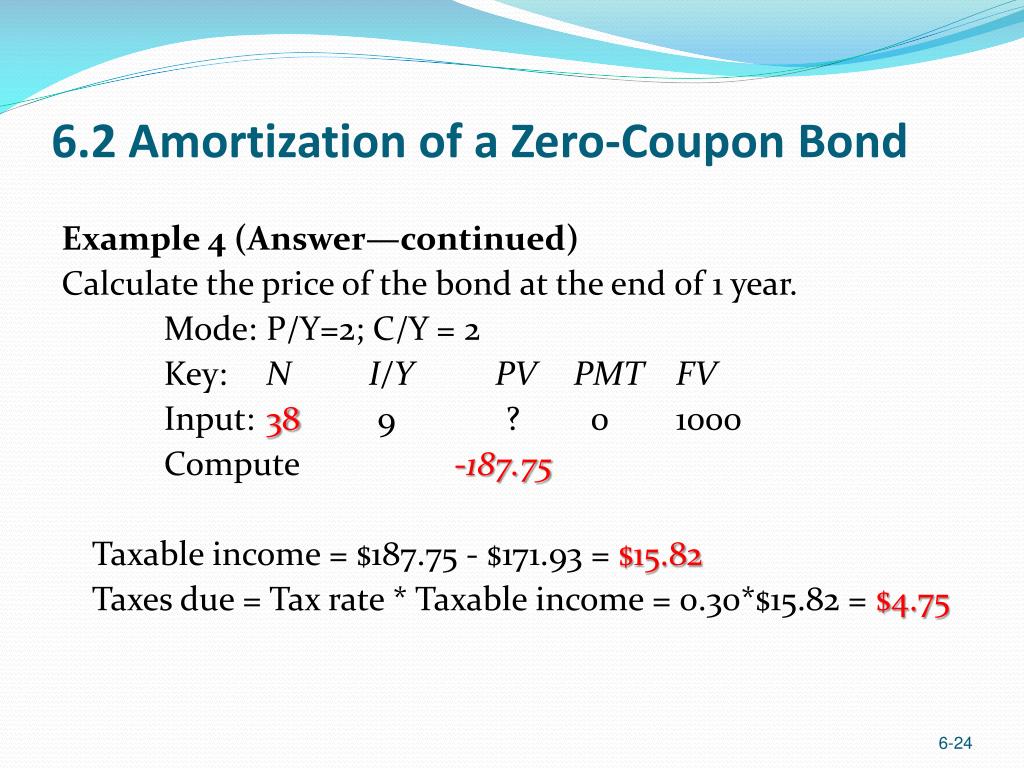

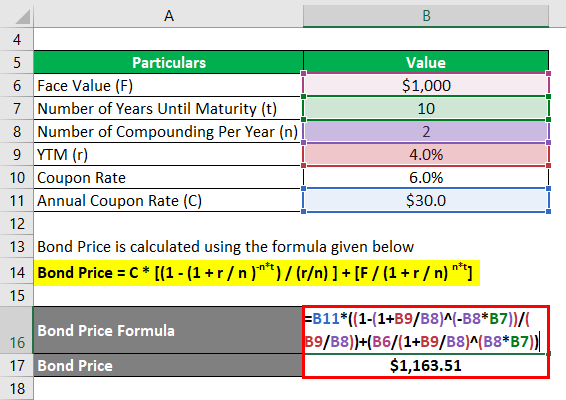

Zero Coupon Bond Value Calculator - BuyUpside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield ...

Present value of zero coupon bond calculator

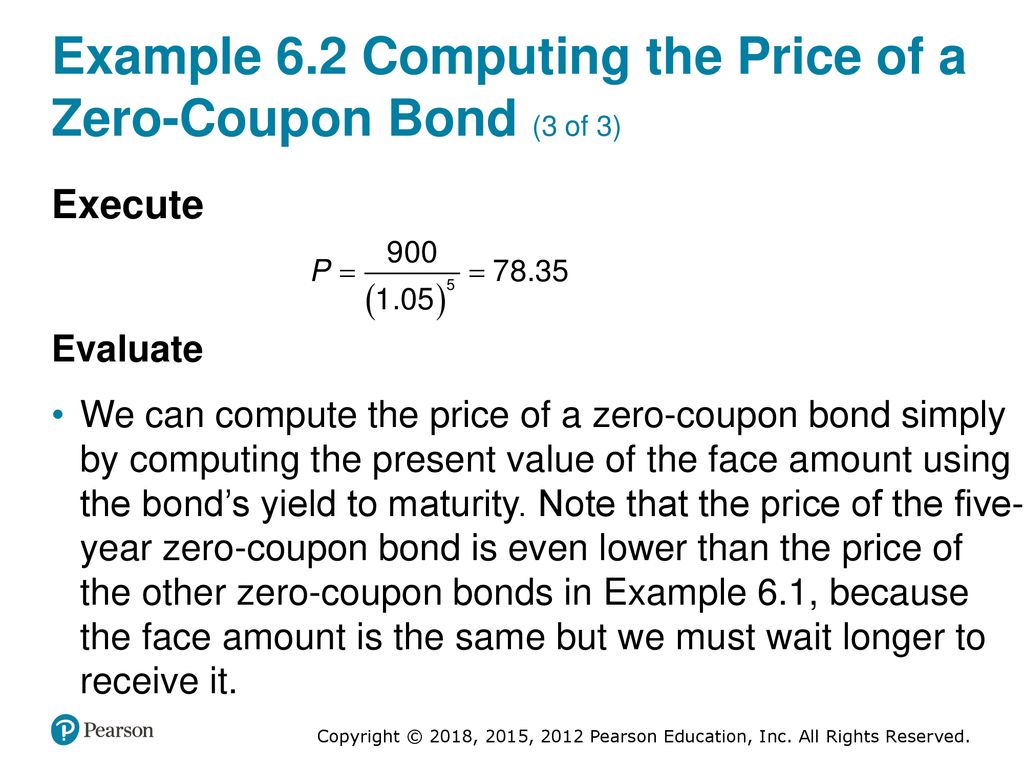

Zero Coupon Bond Calculator - MiniWebtool When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula. The zero-coupon bond ... Price of Zero-Coupon Bond Calculator - מחשבונים When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include U.S. Treasury bills, U.S. savings bonds ... How to Calculate Yield to Maturity of a Zero-Coupon Bond Instead, z-bonds are issued at a discount and mature to their face value. As a result, YTM calculations for zero-coupon bonds differ from traditional bonds.

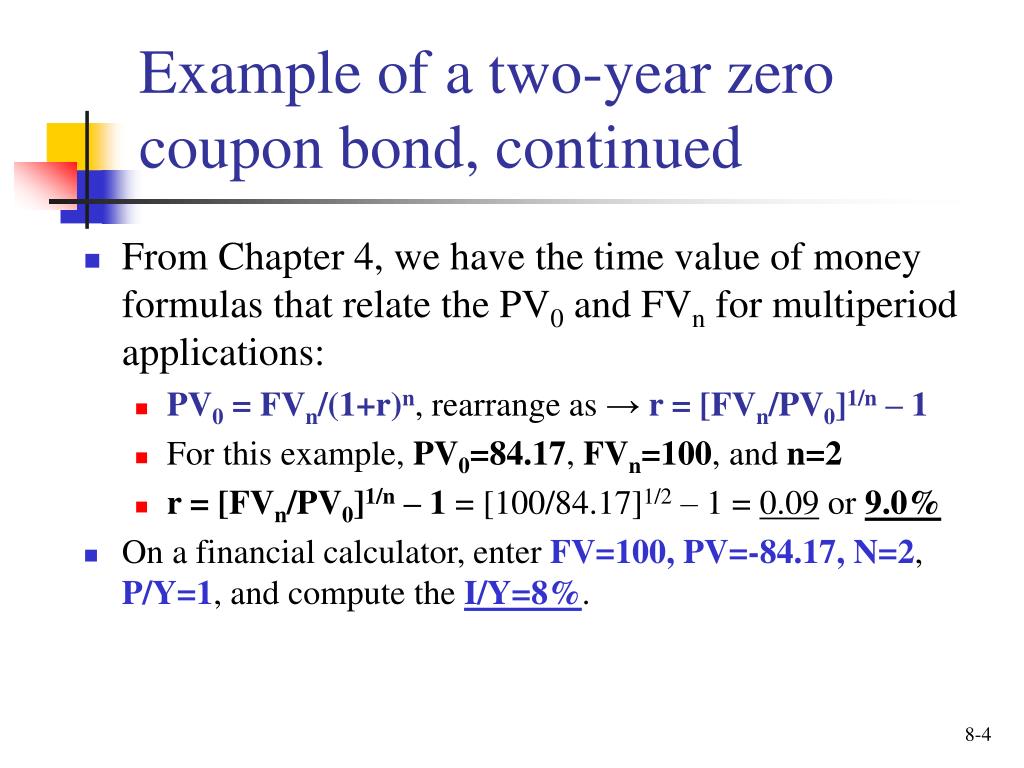

Present value of zero coupon bond calculator. Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep Zero-Coupon Bond ; Formula · PV = Present Value; FV = Future Value; r = Yield-to-Maturity (YTM) ; Model Assumptions. Face Value (FV) = $1,000; Number of Years to ... Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ A zero coupon bond is a bond which doesn't pay any periodic payments. Instead it has only a face value (value at maturity) and a present value (current value). Calculate Zero-coupon Bond Purchase Price Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power ... Zero Coupon Bond Value - Financial Formulas (with Calculators) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years.

How to Calculate Yield to Maturity of a Zero-Coupon Bond Instead, z-bonds are issued at a discount and mature to their face value. As a result, YTM calculations for zero-coupon bonds differ from traditional bonds. Price of Zero-Coupon Bond Calculator - מחשבונים When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include U.S. Treasury bills, U.S. savings bonds ... Zero Coupon Bond Calculator - MiniWebtool When the bond reaches maturity, its investor receives its face value. It is also called a discount bond or deep discount bond. Formula. The zero-coupon bond ...

Post a Comment for "42 present value of zero coupon bond calculator"