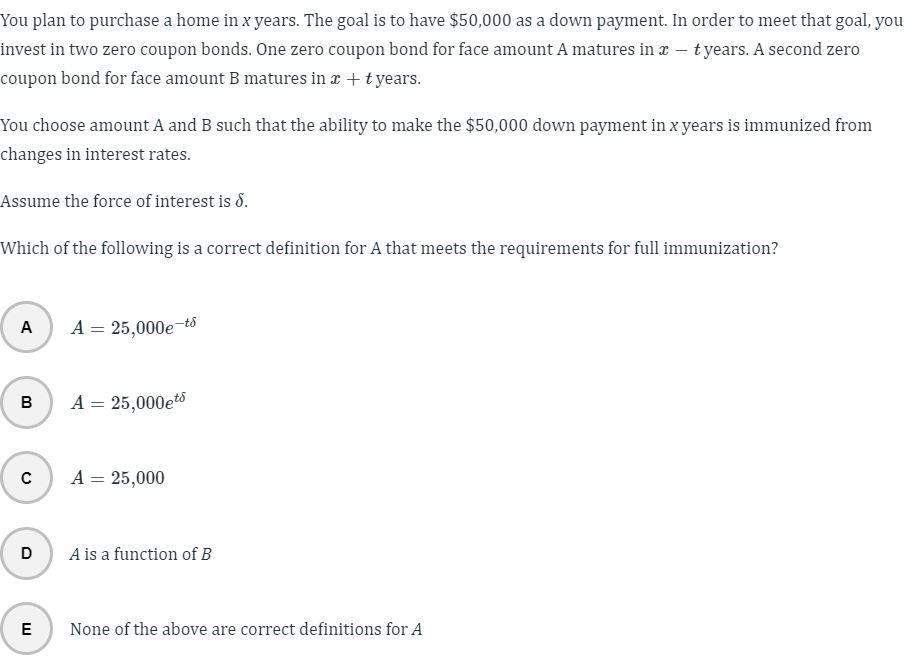

44 zero coupon bonds definition

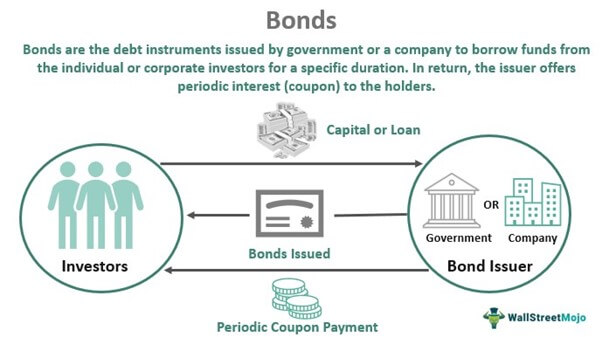

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon bonds include US Treasury bills, US ... Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due.

Zero Coupon Bond - Definition - Moneychimp Zero Coupon Bond A bond that sells at a huge discount and pays no interest.

Zero coupon bonds definition

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,... Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when...

Zero coupon bonds definition. What Is a Zero-Coupon Bond? Definition, Advantages, Risks A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. Zeros-coupon bonds are ideal for long-term, targeted financial needs... Zero-Coupon Bonds: Pros and Cons - Management Study Guide Zero-coupon bonds are those bonds that are sold at a deep discount to their face value. This means that these bonds do not receive any periodic interest. Instead, the investors have to invest a lump sum amount at the beginning of their investment and get paid a higher lumpsum amount at the end of their investment. Section 2(48) Income Tax: Zero Coupon Bonds - CA Club a) Meaning of 'Zero Coupon Bond': Section 2 (48) Income Tax. As per Section 2 (48) of Income Tax Act, 1961, unless the context otherwise requires, the term "zero coupon bond" means a bond-. (a) issued by any infrastructure capital company or infrastructure capital fund or public sector company or scheduled bank on or after the 1st day ... United States Treasury security - Wikipedia Treasury bonds (T-bonds, also called a long bond) have the longest maturity at twenty or thirty years. They have a coupon payment every six months like T-notes.. The U.S. federal government suspended issuing 30-year Treasury bonds for four years from February 18, 2002, to February 9, 2006.

How to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · Zero-coupon bonds often mature in ten years or more, ... Definition, Formula, and Example. Bond valuation is a technique for determining the theoretical fair value of a particular bond. Zero-coupon bond - Definition, Meaning & Synonyms a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security zero coupon bonds definition and meaning | AccountingCoach zero coupon bonds definition. A bond without a stated interest rate. Because no interest is paid, the bond will sell for a discount from its maturity value. Rather than receiving interest, an investor's compensation will be the difference between the discounted price at which the bond was purchased and the price the investor receives when ... Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Zero Coupon Bond, also known as the discount bond, is purchased at a discounted price and does not pay any coupons or periodic interests to the fundholders. Money invested in Zero Coupon Bond does not generate a regular interest during the tenure.

Zero-Coupon Bonds - Accounting Hub A zero-coupon bond is a debt instrument and it pays no periodic interest. This bond is traded at a deep discount to its face value. US treasury bills are a prime example of zero-coupon bonds. These bonds are also called discount bonds. These bonds can be issued with zero interest from the beginning. Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Zero-Coupon Bond Definition - Investopedia A zero-coupon bond is a debt security instrument that does not pay interest. Zero-coupon bonds trade at deep discounts, offering full face value (par) profits at maturity. The difference between... Zero-coupon bond financial definition of Zero-coupon bond A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value.

Zero Coupon Bond: Meaning, Features & Advantages - BondsIndia A zero-coupon bond is a debt instrument wherein the issuer does not make any coupon payment but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full-face value. A zero-coupon bond will usually have higher returns than a regular bond with the same maturity because of the shape of the yield curve.

Bond (finance) - Wikipedia The bondholder receives the full principal amount on the redemption date. An example of zero coupon bonds is Series E savings bonds issued by the U.S. government. Zero-coupon bonds may be created from fixed rate bonds by a financial institution separating ("stripping off") the coupons from the principal. In other words, the separated coupons ...

How to Buy Zero Coupon Bonds | Finance - Zacks Zero coupon bonds, also known as zeros, are distinct in that they do not make annual interest payments. The bonds are sold at a deep discount, and the principal plus accrued interest is paid at the...

What is a Zero-Coupon Bond? Definition, Features, Advantages ... Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date.

Zero Coupon Bond | Definition, Formula & Examples - Study.com A zero-coupon bond, which is also referred to as "an accrual bond", is a debt security that does not provide investors with periodic payments or periodic interests. Instead, this type of financial...

Convertible Bonds: Definition and Example Calculation Where: C is coupon value, r is rate, n is year and CV is conversion value. Example: ABC Co has issued 100,000 units of convertible bonds with a nominal value of US$100 each. The coupon rate of the bonds is 10% payable annually. Each of the US$100 convertible bonds can be converted into 50 ordinary shares in three years’ time.

Zero-coupon bond - definition of zero-coupon bond by The Free Dictionary Noun. 1. zero-coupon bond - a bond that is issued at a deep discount from its value at maturity and pays no interest during the life of the bond; the commonest form of zero-coupon security. zero coupon bond. governing, government activity, government, governance, administration - the act of governing; exercising authority; "regulations for the ...

What Is a Bond Coupon? - The Balance A bond's coupon refers to the amount of interest due and when it will be paid. A $100,000 bond with a 5% coupon pays 5% interest. The broker takes your payment and deposits the bond into your account when you invest in a newly issued bond through a brokerage account. There it sits alongside your stocks, mutual funds, and other securities.

Zero Coupon Bonds financial definition of Zero Coupon Bonds A bond that provides no periodic interest payments to its owner. A zero-coupon bond is issued at a fraction of its par value (perhaps at $3 to $5 for each $100 of face value for a long-term bond) and increases gradually in value as it approaches maturity. Thus, an investor's income from a zero-coupon bond comes solely from appreciation in value.

What is a Zero-Coupon Bond? - Robinhood A zero-coupon bond is a type of debt security that trades at a discount and where the only payment occurs when the bond reaches maturity. 🤔 Understanding a zero-coupon bond Most bonds create a consistent income for the bondholder in the form of interest payments.

Callable Bonds (Definition, Example) | How it Works? The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate. read more; Coupon Rate of Bond Coupon Rate Of Bond The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security).

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... A zero-coupon bond is a financial instrument that does not render interest. They normally trade at high discounts, and offer full face par value, at the time of maturity. The spread between the purchase price of the bond and the price that the bondholder receives at maturity is described as the profit of the bondholder.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org The One-Minute Guide to Zero Coupon Bonds Most bonds make regular interest or "coupon" payments—but not zero-coupon bonds. Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall.

What is a Zero Coupon Bond? - Definition | Meaning | Example A Zero coupon bond is a bond that sells without a stated rate of interest. This way the company or government doesn't have to worry about changing interest rates. These bonds are sold at a discount don't pay a standard monthly interest percentage like normal bonds do. Instead, investors receive the gain of the appreciated bond at maturity.

Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia Zero-coupon U.S. Treasury bonds are also known as Treasury zeros, and they often rise dramatically in price when stock prices fall. Zero-coupon U.S. Treasury bonds can move up significantly when...

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

What Is a Zero-Coupon Bond? Definition, Characteristics & Example Like regular bonds, zero-coupon bonds are financial securities that mature over time, and their face (par) value is paid to their holder at the end of their term. Unlike coupon-paying bonds,...

Post a Comment for "44 zero coupon bonds definition"